MarketWatch has highlighted these products and services because we think readers will find them useful. This content is independent of the MarketWatch newsroom and we may receive a commission if you buy products through links in this article.

If you have high-interest student loan debt, it might be difficult to make progress paying down your balance. Student loan refinancing could be an effective way to lower your interest rates or reduce your monthly payments, which can help you manage your debt as well as save money.

Student loan refinancing allows you to adjust the interest rate and repayment term on your student loans by taking out a new loan that pays off some or all of your existing student debt.

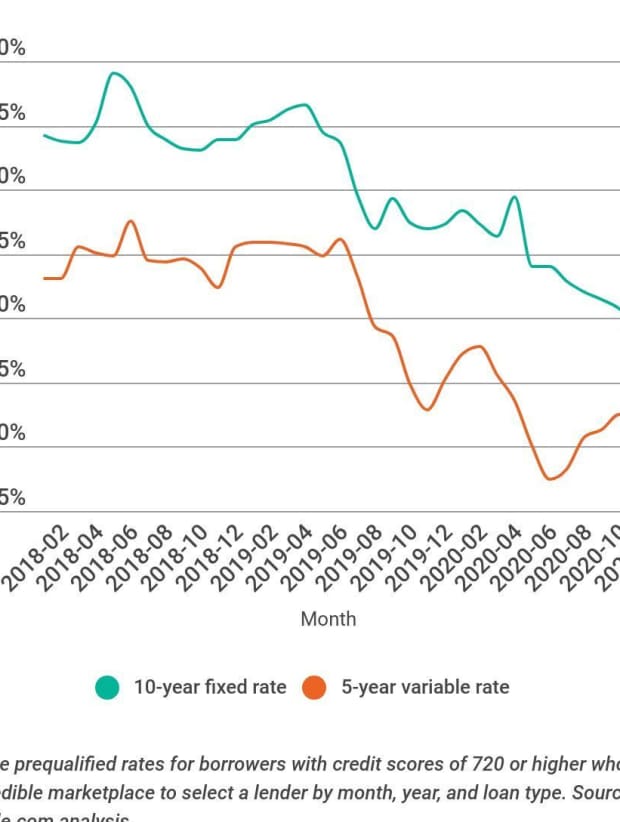

10-year, fixed refinancing rates are currently at record lows, which could make this a great time for you to refinance your private student loans if you qualify. Because of COVID-19, federal student loan payments and interest have been paused through Sept. 30, 2021. That means that, for now, refinancing your federal loans isn’t the best idea.

Student loan refinancing rates have fallen since April

The Federal Reserve has responded to the coronavirus pandemic by slashing interest rates to record lows. As of October 2020, the Federal Reserve’s target federal funds rate ranges from 0% to 0.25%. Since student loan refinance rates usually follow the trend of the target federal funds rate, this means you might qualify for a lower rate than you could even a year ago.

If the economy improves, the Federal Reserve will likely raise its federal funds rate range. This will make it more expensive for lenders to borrow money, which means rates will likely go up, too. This is why now is such a good time to take advantage of the low rates before they rise again.

You can see how dramatically rates have fallen in the chart below:

See more:Student loan refinancing historic rate trends

How much could I save by refinancing?

The average federal student loan payment is $393 per month, though this might be lower or higher depending on your degree. From 2006 to 2021, the average interest rate for undergraduate students was 4.66%, and the average interest rate for graduate students was 6.22%.

Let’s say you had $35,359 in student loans at 6.22% interest. With a 10-year repayment term, your minimum monthly payment would be $396 per month, and you’d pay $12,218 in interest charges over the life of your loan.

If you refinanced your debt and qualified for a 10-year loan at 4% interest, your monthly payment would drop to $358 — allowing you to save $38 per month. Over the course of your loan repayment, you’d pay just $7,600 interest charges — saving you over $4,600.

| Original Loan at 6.22% Interest | Refinanced Loan at 4% Interest | |

| Loan Balance | $35,359 | $35,359 |

| Loan Term | 10 Years | 10 Years |

| Minimum Payment | $396 | $358 |

| Total Interest Paid | $12,218 | $7,600 |

| Total Savings: | $4,618 |

If you decide to refinance your student loans, be sure to consider as many lenders as possible to find the right loan for you. This is easy with Credible — you can see your rates from our partner lenders in the table below in two minutes.

How to refinance a student loan

If you decide to refinance student loans, follow these three steps:

1. Know your credit score

There are several factors that influence the interest rate you get, including your credit score. You’ll typically need good to excellent credit to get the best rates. If you have poor or fair credit, having a creditworthy cosigner might make you eligible for a lower interest rate.

Even if you don’t need a cosigner to qualify for refinancing, applying with a cosigner could help you get you a lower interest rate than you would on your own.

2. Compare student loan refinance lenders

Each refinancing lender has its own rates, term, and approval requirements. You might qualify for a loan with lower interest rates or better repayment terms from one lender versus another — so it’s a good idea to consider as many lenders as possible to find the right loan for you.

When you’re comparing lenders, be sure to look at their interest rates, repayment terms, fees, and whether they accept cosigners on applications. Credible makes this easy — you can compare multiple student loan refinancing lenders in two minutes after filling out a single form.

3. Stay current with your monthly payments

Once you’ve refinanced your loans and your old debt has been paid off, it’s important to stay on top of your monthly payments. Making all of your payments on time helps you build a strong credit history and keeps you out of the danger of student loan default.

Setting up automatic payments can be a good way to avoid missing due dates. Some lenders also offer interest rate discounts if you sign up for autopay, which means you could save money and keep your loan current at the same time.

Is it worth it to refinance a student loan?

Refinancing your student loans could be a good idea if you can lower your interest rate or reduce your monthly payment. Before you decide, it’s a good idea to consider the pros and cons:

Pros of refinancing

- Could get a lower interest rate: If you qualify for a lower interest rate, you could save thousands of dollars on interest charges over the life of your loan.

- Might be able to pay off your debt early: If you can lower your interest rate or shorten your repayment term, you could potentially pay off student loans faster.

- Can make repayment more manageable: If you refinance multiple student loans, you’ll end up with one loan and one payment. This could make your repayment much easier to keep track of in the long run.

Cons of refinancing

- Potentially higher interest charges: If you decide to extend your repayment term, you might get a lower monthly payment. However, this also means you could end up paying more interest over time.

- Loss of federal benefits: If you refinance federal student loans, you’ll lose access to federal benefits and protections. These include access to income-driven repayment plans and student loan forgiveness programs.

If you decide to refinance your loans, remember to consider as many lenders as possible. This way, you can find a loan that fits your needs.

Kat Tretina is a contributor to Credible who covers everything from student loans to personal loans to mortgages. Her work has appeared in publications like the Huffington Post, Money Magazine, Business Insider, and more.

"can" - Google News

January 27, 2021 at 02:03AM

https://ift.tt/39koOxN

Student Loan Refinance Rates Hit Record Lows — Here’s How You Can Save - MarketWatch

"can" - Google News

https://ift.tt/2NE2i6G

https://ift.tt/3d3vX4n

Bagikan Berita Ini

0 Response to "Student Loan Refinance Rates Hit Record Lows — Here’s How You Can Save - MarketWatch"

Post a Comment